Business Insolvency Company Specialists: Helping You Conquer Financial Obstacles

Business Insolvency Company Specialists: Helping You Conquer Financial Obstacles

Blog Article

Explore the Trick Conveniences and Advantages of Making Use Of Bankruptcy Solutions for Your Economic Circumstance

Navigating economic difficulties can be an overwhelming task, particularly when faced with insurmountable debts and unclear financial futures. In such requiring scenarios, seeking the proficiency of insolvency services can supply a lifeline to businesses and people alike. These specialized services provide a variety of solutions created to minimize the burden of financial debt, restructure monetary responsibilities, and pave the means towards a more stable financial structure. By comprehending the crucial advantages and benefits connected with making use of insolvency solutions, individuals can obtain beneficial understandings right into just how to address their monetary dilemmas properly and proactively.

Understanding Bankruptcy Services

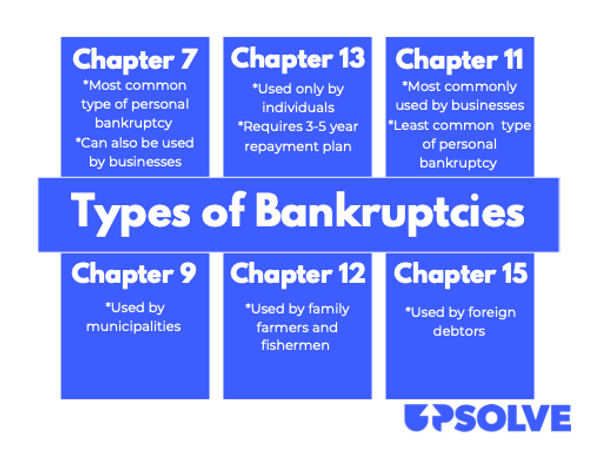

When facing financial difficulties, individuals and businesses can profit from recognizing bankruptcy services to browse their scenario efficiently. Bankruptcy services incorporate a variety of options designed to help organizations and individuals attend to economic obstacles and restore security. These services often consist of financial debt restructuring, arrangement with financial institutions, asset liquidation, and insolvency procedures.

By seeking help from bankruptcy specialists, people can acquire a clear understanding of their financial alternatives and create a critical strategy to address their financial debts. Bankruptcy experts have the competence to examine the monetary situation, recognize the origin of the insolvency, and suggest one of the most ideal training course of action.

Additionally, recognizing insolvency solutions can give individuals with useful understandings right into the legal effects of their monetary situation. This knowledge can help individuals make educated decisions about just how to continue and safeguard their passions during the bankruptcy procedure.

Financial Debt Consolidation Solutions

Discovering efficient financial debt loan consolidation services can offer people and services with a structured approach to handling their monetary obligations. Financial obligation loan consolidation entails incorporating several debts right into a single loan or settlement plan, commonly with a reduced rate of interest or extended settlement terms. This strategy can help streamline funds, decrease the danger of missed out on payments, and potentially lower month-to-month repayments.

One common debt combination solution is a debt combination financing, where organizations or individuals obtain a lump amount to repay existing financial obligations and after that make single regular monthly repayments towards the brand-new lending. An additional option is a debt monitoring strategy, where a credit rating therapy agency works out with lenders to lower rate of interest or waive charges, enabling the debtor to make one consolidated monthly payment to the company.

Working Out With Creditors

Bargaining efficiently with creditors is an important step in fixing economic troubles and locating feasible remedies for financial obligation settlement. When facing bankruptcy, open communication with lenders is vital to reaching mutually helpful arrangements. By launching discussions with creditors at an early stage, people or services can show their determination to attend to the debt problem properly.

Throughout settlements, it's important to give lenders with a clear introduction of your financial circumstance, including earnings, costs, and assets. Transparency builds depend on and enhances the likelihood of reaching a favorable outcome. Furthermore, recommending realistic repayment strategies that take into consideration both your financial abilities and the lenders' rate of interests can lead to effective agreements.

Personalized Financial Assistance

Establishing a solid structure for financial recovery entails looking for customized monetary support customized to your particular conditions and goals. Business Insolvency Company. Customized monetary advice plays a crucial function in browsing the intricacies of bankruptcy and creating a critical plan for regaining monetary stability. By working very closely with a monetary advisor or insolvency professional, you can gain beneficial insights right into your financial situation, identify areas for improvement, and create a roadmap for accomplishing your monetary goals

One of the key advantages of tailored financial guidance is the chance to get tailored guidance that considers your distinct financial conditions. A financial expert can evaluate your earnings, properties, financial debts, and expenditures to give tailored suggestions that line up with your goals. This individualized approach can aid you make educated decisions, prioritize your financial responsibilities, and create a sustainable financial plan for the future.

Additionally, tailored economic support can supply continuous assistance and liability as you function in the direction of improving your financial scenario. By partnering with a well-informed advisor, you can acquire the confidence and experience required to overcome monetary challenges and develop a stronger financial future.

Course to Financial Recovery

Navigating the trip towards financial recuperation needs a critical technique and disciplined monetary monitoring. To start this course successfully, people have to first examine their present financial scenario thoroughly. This entails recognizing the degree of financial debts, evaluating income sources, and identifying expenses that can be trimmed to reroute funds in the direction of financial debt payment or financial savings.

As soon as a clear picture of the financial landscape is established, creating a practical spending plan becomes vital - Business Insolvency Company. Budgeting permits for the allotment of funds in the direction of financial debt settlement while making sure that vital expenses are covered. It likewise acts as a tool for tracking development and making needed changes along the road

Conclusion

Finally, utilizing bankruptcy solutions supplies various advantages and benefits for individuals facing economic troubles. These services supply financial debt loan consolidation remedies, assistance negotiate with creditors, provide customized monetary support, and lead the method towards economic healing. By seeking insolvency services, people can take aggressive steps in the direction of boosting their economic circumstance and achieving long-lasting security.

By functioning collaboratively with companies, individuals and creditors can navigate challenging monetary conditions and lead the method towards an extra steady financial future.

:max_bytes(150000):strip_icc()/final6-f3f8da33370942739f81bd8fe8c7c53f.jpg)

One of the key benefits of customized financial support is the possibility to get customized recommendations that considers your special economic scenarios. These solutions offer financial debt consolidation solutions, assistance bargain with financial institutions, offer individualized monetary support, and pave the method towards financial recovery.

Report this page